After a delay caused by the Fourth of July holiday, the ferrous scrap metal market settled mostly sideways across much of the Midwest, suggesting that the market may have finally bottomed out.

Chicago’s Ferrous Scrap Market

Despite bearish market forecasts, all ferrous grades in Chicago remained at June’s price levels, except for steel turnings, which increased by $20 per gross ton. Hot-rolled coil (HRC) prices, reduced scrap metal flows, stable pig iron prices, and steady export activity have combined to shape July’s scrap metal market across the US, and the strong-side ways market is also signaling we may have found the market floor.

“It feels like we’ve finally hit the bottom of the market,” states Lou Plucinski, President. “Scrap demand is strong, and supply is relatively low across much of the Midwest.”

The ongoing decline in HRC prices have pressured the scrap metal market since the beginning of the year. After steep HRC price declines throughout June it is anticipated that this could be the bottom for hot-band prices before mills push through price increases. Fastmarkets’ daily steel hot-rolled coil index, FOB mill US Midwest, was calculated at $32.56 per cwt ($651.20 per short ton) on Wednesday, July 10th, creating a cost spread of $348 per gross ton between HRC and Chicago’s No. 1 Busheling.

Steel turnings were the only commodity that saw an increased this month. Generally, steel turnings are less desirable to steel mills due to their lower ferrous content, reduced bulk density, and lower FE recoveries. However, the steel turning market has maintained the most consistent prices, fluctuating by only plus or minus $20 per gross ton since the beginning of the year. Steel mills that can consume them have recognized their value, leading to an increase in their desirability.

Steel turnings were the only commodity that saw an increased this month. Generally, steel turnings are less desirable to steel mills due to their lower ferrous content, reduced bulk density, and lower FE recoveries. However, the steel turning market has maintained the most consistent prices, fluctuating by only plus or minus $20 per gross ton since the beginning of the year. Steel mills that can consume them have recognized their value, leading to an increase in their desirability.

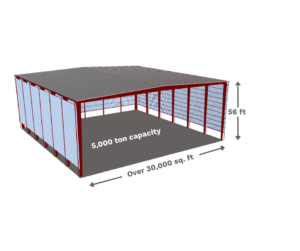

Breaking News: BL Duke has broken ground on an innovative steel turnings’ containment building, a first-of-its-kind project in the Midwest and a significant step forward in safeguarding the cradle-to-grave responsibility of our recycling partners. The state-of-the-art structure will completely enclose steel turnings and cast iron borings at BL Duke’s 60-acre site in Joliet, IL. It is designed to shield the metal turnings from rainwater and prevent environmental runoff, marking a major advancement in upholding our customers’ cradle-to-grave obligations.

Breaking News: BL Duke has broken ground on an innovative steel turnings’ containment building, a first-of-its-kind project in the Midwest and a significant step forward in safeguarding the cradle-to-grave responsibility of our recycling partners. The state-of-the-art structure will completely enclose steel turnings and cast iron borings at BL Duke’s 60-acre site in Joliet, IL. It is designed to shield the metal turnings from rainwater and prevent environmental runoff, marking a major advancement in upholding our customers’ cradle-to-grave obligations.

“We are just a few months away from launching our new, state-of-the-art steel turnings facility. What excites me most is its environmental commitment and the peace of mind it will bring to our customers,” states Bobby Brown, Sales Manager.

Chicago’s Nonferrous Scrap Market

The Fourth of July holiday brought domestic summer shutdowns and routine furnace maintenance. Aluminum prices and demand have remained stable month-to-month, with export prices helping to sustain the market. While there isn’t much to report currently, the outlook for the second half of 2024 appears bleak, with minimal movement expected in aluminum scrap demand and pricing for both primary and secondary alloys.

The stainless steel market continues its stagnant trend. Prices for 304 stainless steel in the UK remained stable as June trading concluded. However, most market consumers are still buying for June melt programs due to low inventory levels and a soft flow of material into scrap yards. It is anticipated that prices will decline slightly when July buying begins. With expectations of lower prices in the coming week, most scrap yards have been selling off their inventories. Consequently, July is likely to see limited purchasing from domestic and international consumers of stainless steel scrap until they work through their existing inventories, leading to a lower scrap price point.

The stainless steel market continues its stagnant trend. Prices for 304 stainless steel in the UK remained stable as June trading concluded. However, most market consumers are still buying for June melt programs due to low inventory levels and a soft flow of material into scrap yards. It is anticipated that prices will decline slightly when July buying begins. With expectations of lower prices in the coming week, most scrap yards have been selling off their inventories. Consequently, July is likely to see limited purchasing from domestic and international consumers of stainless steel scrap until they work through their existing inventories, leading to a lower scrap price point.

The copper market is showing slight improvement as July begins, following Federal Reserve Chairman Jerome Powell’s comments indicating that economic data suggests inflation is moving downward. In June, Comex copper prices fell to just under $4.40 per pound but have since rebounded to around $4.55 per pound, just below the $4.60 per pound. level from a month ago.