As we move into the latter half of 2021, the US scrap market remains competitive. The semiconductor chip shortage continues to be the star of the show with many automakers on halt, creating more high demand for prime grades across the US. The drop in auto input has also increased the spread between prime and cut grades of scrap. Most large mill groups believe the strength will last well into first quarter of 2022, even with automakers picking up the pace. In Chicago July’s scrap metal prices have increased $20 per gross ton from June on prime grades, while cut grades remain at June’s levels and Steel Turnings dropped $10 per gross ton. Domestic steel mills have been unable to secure enough scrap to meet demand thus, we are seeing another increase in 2021. The unknown and lingering question is, how long can steel pricing be sustained at these levels?

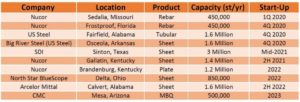

COVID and the semiconductor shortage continue being the two main factors contributing to the bullish scrap market of 2021. Another major industry change that could lead to long term high scrap prices is the push for “Green Steel,” creating more opportunities for Electric Arc Furnaces (EAFs). EAFs have a larger appetite for steel at 75% scrap, versus the traditional Basic Oxygen Furnace (BOF – blast furnaces) and coke ovens. The US alone has 8M tons of EAF capacity expected to ramp up in 2021 and 2022.

We can look to the automotive industry as a trend indicator in the scrap market. Prime scrap, such as No.1 Busheling, is a main byproduct of the automotive manufacturing process due to the plethora of stamped components. When the US auto manufacturers shut down in 2020, we saw prime grades initially plummet during COVID but quickly snap back as production resumed. Fast forward to 2021, now working through a microchip shortage, causing auto makers to limit or stop production on new vehicles all over again – this time creating even more demand for prime scrap at the mill level.

From commodity-to-commodity July’s non-ferrous outlook remains strong. Most consumers do not expect to see much volatility in price points. While we have seen a 6-7% decline in copper and brass pricing, the demand domestically and overseas remains very strong. Experts are predicting prices to remain at the current levels. Aluminum consumers still have very strong need for material and the expectation from traders is that pricing will remain at these levels. Stainless Steel and Nickel is the bright spot! Entering July, we have seen prices move up 7-8% this week. Demand is high and consumers have been willing to pay more for certain alloys.

Do you plan to attend Fabtech at McCormick Place, September 13th – 16th? Stop by and visit the BL Duke Team in Hall D – Booth #D46740.