The US ferrous scrap market is fatigued with prices falling after a strong start to 2023. Non-ferrous markets are also experiencing downward pressure, with a bearish outlook into the summer months.

Chicago’s Ferrous Scrap Metal Market

After a strong first quarter, US ferrous scrap markets have made a turn with prices softening $10 – $40 per gross ton in Chicago. Increased supply, mill outages, falling pig iron prices, a weaker export market, and the scheduled 120-day river closure are adding downward pressure to Chicago’s scrap market. Cut grades decreased $30 per gross ton while prime grades settled at $10 per gross ton discount compared to April. Machine Shop Turnings took the biggest hit at down $40 per gross ton. This is the first time prime grades have declined since the market started to recover in December 2022 and they have performed better than their cut and shred counterparts due to relatively tight supply.

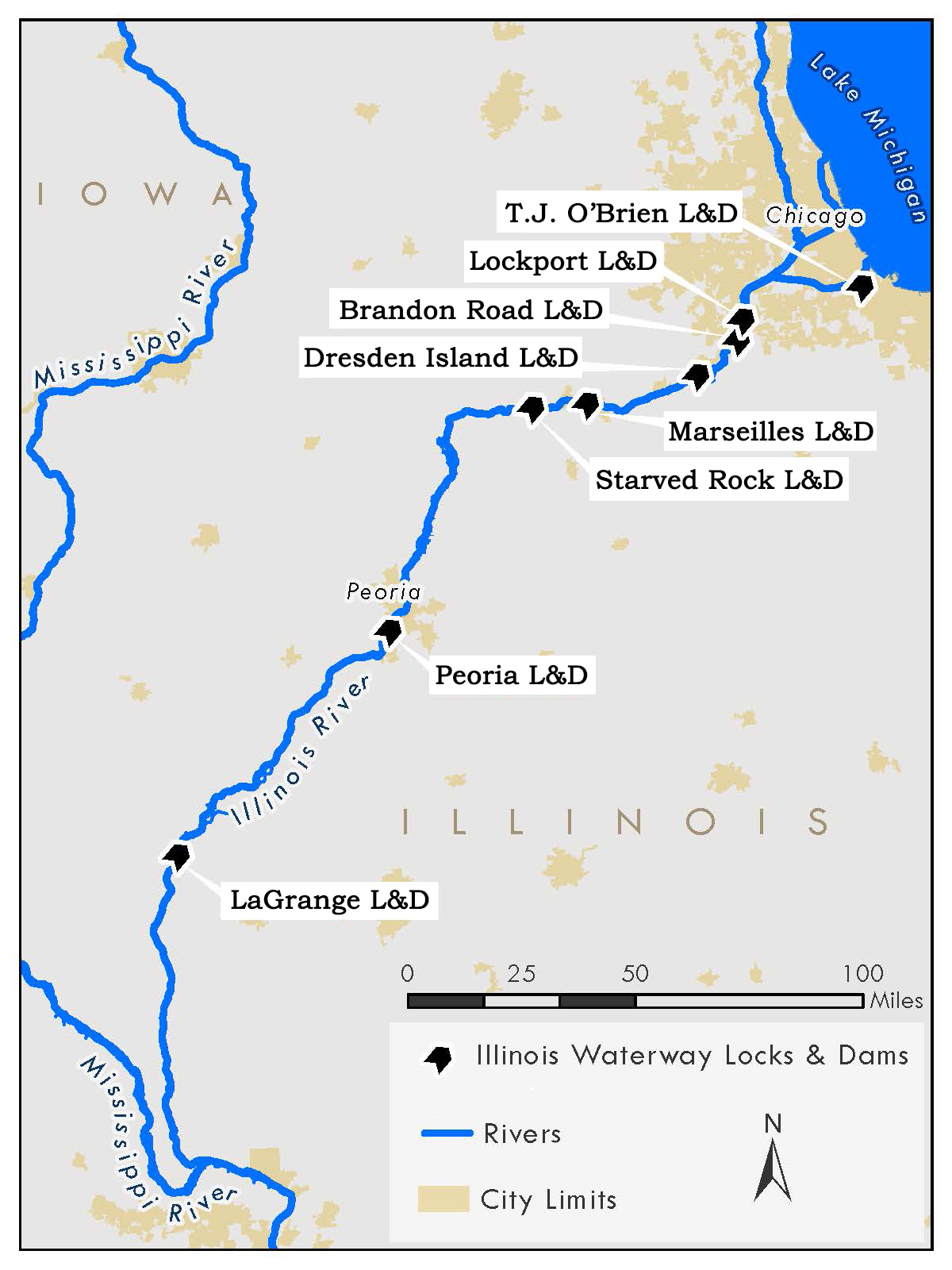

The flooding along the upper portion of the Mississippi River is causing restrictions of barge shipments and choking scrap supply to various regions. The scheduled river closure, which begins on June 1st through September 30th, was already expected to impact barge transportation and Chicago’s scrap market. The Army Corps of Engineers are closing the Brandon Road Lock and Dam for the final phase of repairs which began in 2019. During the scheduled closure, no vessels will be able to pass through the lock, limiting scrap metal sales in Chicago to steel mills accessible by truck and rail during the 120 day closure.

“We expect the closure to have a significant effect on scrap pricing in Chicago as it will create an oversupply in the region. BL Duke will continue to honor our commitments to mills in the south by transferring scrap to a leased barge terminal below the closures,” states, Lou Plucinski, President.

Turkey finished April with a minimum of eight US cargo purchases, broadly on par with Turkish imports of US material in the first three months of the year in terms of volume, but the country’s mills secured April’s bookings at incrementally lower prices. US deep-sea ferrous export prices to Turkey decreased approximately $29 per ton between the end of March and the end of April. There is negligible post-Ramadan presence of Turkish mills in the US export market — the Muslim religious holiday concluded with the Eid-Al-Fitr celebrations on April 21. Their absence is expected to give impetus to domestic mills to drive prices down further on cuts and shred, the United States’ most commonly exported grades.

On a positive note, May is the final month of mill outages. An estimated 331,000 short tons of steel production came offline between March through May. NLMK Portage, Indiana’s electric arc furnace is the only mill still out and accounts for 84,400 short tons of steel production. North Star BlueScope, Nucor, and Steel Dynamics were out for a period between March and April and are now back on-line.

Chicago’s Non-Ferrous Scrap Metal Market

The outlook for non-ferrous prices in May seems to be unchanged. Domestic manufacturing has experienced a sixth consecutive month of lower production numbers and May’s order books have not improved. The Chinese manufacturing data also dipped slightly disappointing analysts. Many had hoped some positive data out of China would cause domestic consumers to compete with higher overseas prices and spark an increase in base metal prices. Unfortunately, that is not the case with most consumers both domestic and overseas pointing to a soft sideways market for all non-ferrous markets for the balance of the month.

Domestic copper prices and mill spreads have not changed, but some brass ingot makers are widening their spreads for brass grades against a stagnant Comex price. Copper and brass supply from dealer yards increases during the construction months. In a weak market this gives consumers with weak order books a chance to widen spreads and buy at lower levels.

Do you plan on attending any upcoming events? Let’s schedule a meet-up. Here’s where you’ll find the BL Duke Team, Upcoming Events.