Steel mills hit the brakes and stayed relatively quiet during January’s ferrous trade. What was forecasted to be a big start to 2024’s scrap metal market became contentious, with price delays and markets ultimately trading sideways across most of the Midwest.

Chicago’s Ferrous Scrap Metal Market

Chicago’s scrap metal market settled sideways this month despite the expectation that prices would increase following December’s soaring market. There was no price change for prime grades, cut grades, or steel turnings this month. January’s market was formed by limited domestic trade, a lack of export competition, and inclement weather impacting logistics.

Limited trade delayed regional scrap prices from publishing prior to the 10th day of the month. Fastmarkets methodology states, prices are “usually settled during the first 10 days of each month and are then effective for the entire calendar month.” January’s numbers posted late with Detroit’s prices publishing mid-day on January 10th, and Chicago’s prices posting shortly after.

“Steel mills tried hard to suppress the market this month,” states Lou Plucinski, President. “Scrap dealers have held back tons and refused to sell into an artificially depressed market ultimately resulting in a sideways market.”

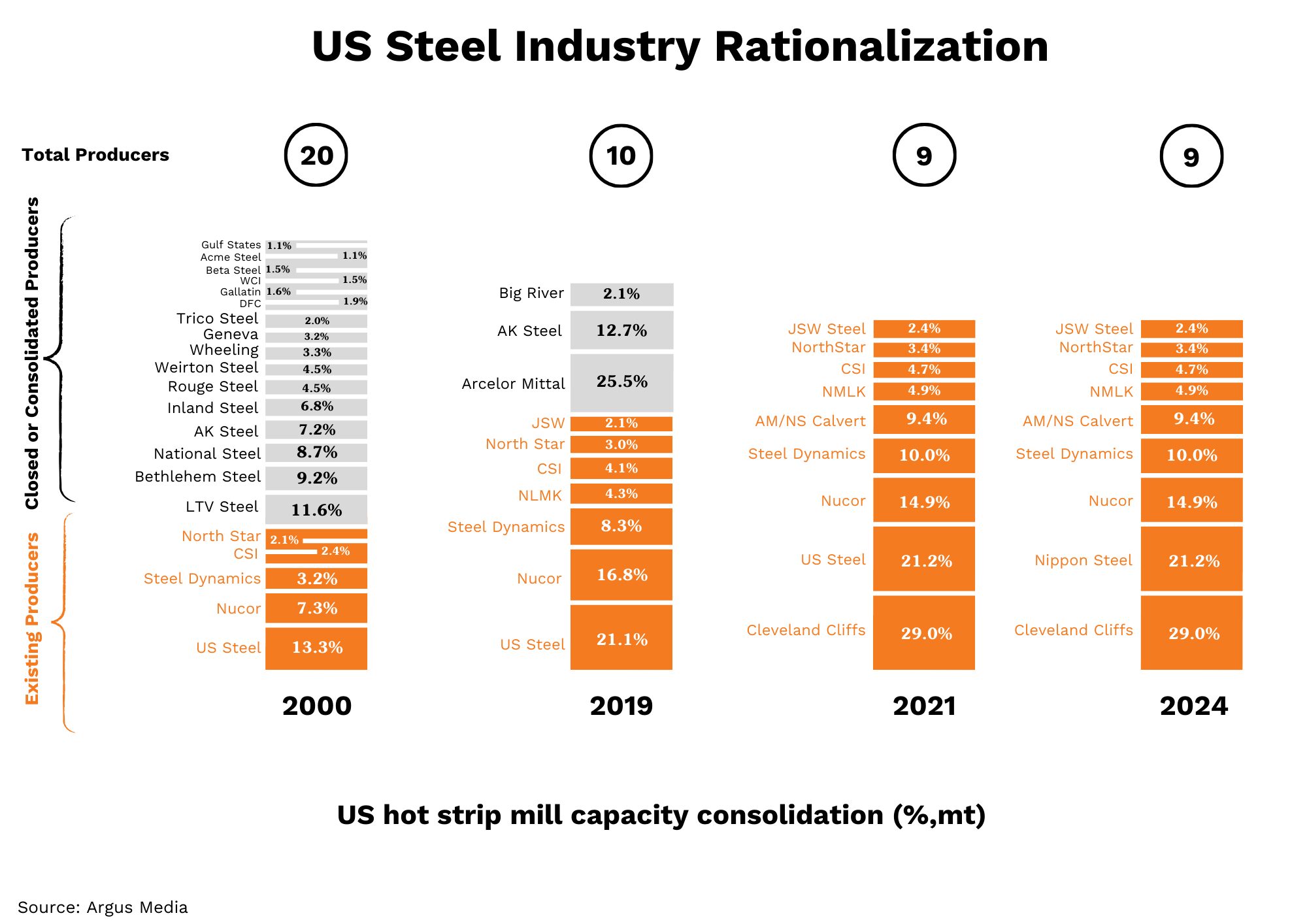

The landscape of the US Steel Industry has drastically changed since the turn of the century, and more change is expected in 2024. Today, fewer than half of the steel mills that were operational in 2000 are still in business. Japanese steelmaker Nippon Steel Corporation will acquire US Steel for $14.9 billion in the second or third quarter of 2024. Nippon is expanding its global operations into the US, and it is currently in Japan, Southeast Asia, and India. The acquisition will create one of the world’s largest steelmakers, producing 86 million tonnes per year and Nippon’s goal is to eventually produce 100 million tons per year.

Before the Nippon Steel deal, Cleveland-Cliffs was thought to be the frontrunner for the acquisition- which would have given Cliffs 50 percent of US hot strip capacity and further contributed to the consolidation of the US steel industry.

Winter months are grueling for scrap dealers due to inclement weather and logistical challenges. Severe weather conditions around the country have slowed scrap flows. Scrap dealers are reporting fewer inbound deliveries, and inclement weather has also slowed outbound shipments to steel mills via truck, barge, and rail.

“January’s weather will undoubtedly reduce scrap flows and supply,” states Jim Schulte, Joliet Yard Manager. “At this time of year, my team is laser-focused on transportation challenges, machinery maintenance, potential river closers, and decreased trucking efficiencies that tighten scrap supply.”

Chicago’s Non-Ferrous Scrap Metal Market

Non-ferrous markets are showing some slight improvements as 2024 kicks off. 300-series stainless-steel scrap metal prices improved last week, while 400-series prices continued to trade sideways. Thus far, consumer demand was strong for the first week of January, but inbound flows of stainless-steel scrap are off and are helping bolster the price against a weak LME Nickel price. Just a week later on the heels of a down ferrous market, the pendulum has swung, and prices for stainless steel scrap have started to retreat. The consensus is prices will not increase until the second half of 2024.

Aluminum scrap metal prices have increased by 3-5 percent, depending on the grade, during the first week of 2024. Domestic demand was broadly weak for aluminum scrap in 2023, with destocking significantly affecting sales. Additional destocking still needs to occur during the first part of 2024 to stabilize the market. A return to normalcy is expected in the second half of the year, barring any disruption in the manufacturing sector.

Copper prices are currently trading in the mid $3.80 range, after trading up to the mid $3.90 range before the end of 2023. However, analysts predict the price of copper may almost double over the next two years. The optimistic view on copper is fueled by the push for renewable energy, rising demand driven by the green transition, a likely decline of the U.S. dollar, and an expected cut to interest rates by the U.S. Federal Reserve this year. If the analysts are correct, we may see copper eclipsing its all-time high of $4.86 per pound in March of last year.