During the first week of each month, referred to as “The Buy,” our team negotiates with steel mills to secure purchase orders for all ferrous grades. The remaining three weeks are then focused on fulfilling these orders. Various factors, including supply and demand, mill outages, export demand, weather conditions, and the availability of freight and cost, impact these negotiations. At BL Duke, we prioritize shipping point pricing and take full advantage of our ability to ship materials via truck, rail, and barge.

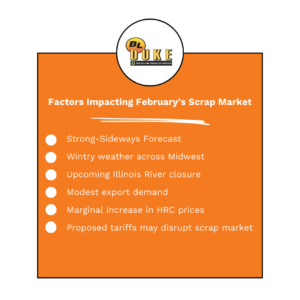

Early forecasts suggest February’s scrap market will settle strong-sideways, influenced by several key factors. Wintry weather is already disrupting material flows, slowing inbound shipments and delaying scrap dealers from fulfilling January orders on time. Adding to the logistical challenges, the 55-day closure of the Lockport Lock on the Illinois River, beginning January 28, will restrict scrap from leaving Chicago by water, creating further transportation bottlenecks. Meanwhile, Hot Rolled Coil (HRC) prices have climbed to $709 per short ton as of January 24, surpassing the $700 threshold sought throughout much of 2024, signaling strengthening demand. Adding to market uncertainty, newly re-elected U.S. President Donald Trump’s threat of a 25% tariff looms, with potential enactment in the coming weeks, injecting further volatility into the outlook. While the proposed tariffs aim to bolster domestic manufacturing, they introduce a level of uncertainty and potential disruption to the scrap metal industry, affecting pricing, supply chains, and international trade dynamics.