After a significant pricing delay, Chicago’s ferrous scrap metal market continued its upward climb in March, marking the third consecutive month of price increases. Strong HRC prices, supply chain disruptions, and robust mill demand continue to fuel bullish momentum. Meanwhile, the back-and-forth on tariff policies are creating uncertainty and volatility to scrap metal flows, demand, and pricing across both ferrous and non-ferrous scrap markets.

Chicago’s Ferrous Scrap Market

In Chicago, March saw a $30 per gross ton increase for prime grades and shred, while cut grades rose by $20 per gross ton, and steel turnings price was unchanged compared to February.

Since the start of the year, prime grades have surged closet to 25%, reaching price levels not seen since February 2024. The primary drivers behind these price hikes are strong demand and persistent supply shortages.

Fastmarkets typically settles ferrous scrap metal markets on or before the 10th of the month, but this month’s publication was delayed until the afternoon of March 12 for the Chicago region, as buyers and sellers continue negotiations amid tight supply and strong demand.

“It feels good to be back in the drivers seat,” said Lou Plucinski, President. “For so long, mills have dictated pricing with little room for negotiation. It’s refreshing to be in a position where real negotiations are taking place again. This month’s extended discussions are a clear sign that the market dynamic is shifting, giving sellers a stronger position.”

Tariffs & Supply Chain Disruptions

The scrap metal market is reacting to rapidly evolving U.S. tariff policies, including reciprocal and retaliatory tariffs on American goods. These measures have already influenced trade flows, demand, and pricing. While the U.S. is a net exporter of recycled materials, many recyclers import metals from Canada and Mexico to supplement domestic supply—imports that will now face a 25% tariff unless exemptions or delays are introduced. Although recycled steel and aluminum remain exempt from Section 232 tariffs, broader trade restrictions are tightening supply, driving up domestic prices, and reshaping material flows.

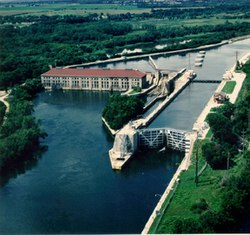

Adding to supply chain disruptions, the reopening of the Lockport Lock on the Illinois River has been postponed, now estimated to occur between April 30 and May 6 due to temporary repairs on cracked pintle castings for both lower miter gates. Initially scheduled to reopen on March 25 after a closure that began on January 28, this delay is prolonging transportation bottlenecks and disrupting scrap shipments within the Chicago market. Another 4–6-week closure is anticipated later this year, pending funding and availability of heavy-lift assets needed for full replacement.

Adding to supply chain disruptions, the reopening of the Lockport Lock on the Illinois River has been postponed, now estimated to occur between April 30 and May 6 due to temporary repairs on cracked pintle castings for both lower miter gates. Initially scheduled to reopen on March 25 after a closure that began on January 28, this delay is prolonging transportation bottlenecks and disrupting scrap shipments within the Chicago market. Another 4–6-week closure is anticipated later this year, pending funding and availability of heavy-lift assets needed for full replacement.

HRC Prices & Mill Demand

Hot-Rolled Coil (HRC) broke $900 per short ton on Tuesday March 4 for the first time since February 2024, while mill lead times have extended to an average of 5.5 weeks, the longest since January 2024. This surge is fueled by a buying frenzy, as companies rush to secure material ahead of impending tariffs, with steel mills unwilling to negotiate lower prices. Strong finished steel market demand is driving mills to aggressively source raw materials to maintain production levels. The rising cost of finished steel is further strengthening ferrous scrap prices, adding to the bullish sentiment in the market.

Chicago’s Non-Ferrous Scrap Market

Aluminum scrap prices, particularly for primary grades, have surged, with some increasing by as much as 10%. The market is experiencing a pricing dislocation due to impending tariffs and sanctions, causing U.S. aluminum prices to climb significantly higher than those on the LME. However, Alcoa has warned that these tariffs could result in the loss of over 100,000 U.S. jobs and would not be enough to drive increased domestic production. The company remains hesitant to restart shuttered facilities without clearer guidance on the duration of the tariffs and access to affordable power. In the near term, key negotiations—such as potential exemptions for Canadian imports and further global aluminum market consolidation—are expected to play a critical role in shaping both finished goods and scrap aluminum prices.

Aluminum scrap prices, particularly for primary grades, have surged, with some increasing by as much as 10%. The market is experiencing a pricing dislocation due to impending tariffs and sanctions, causing U.S. aluminum prices to climb significantly higher than those on the LME. However, Alcoa has warned that these tariffs could result in the loss of over 100,000 U.S. jobs and would not be enough to drive increased domestic production. The company remains hesitant to restart shuttered facilities without clearer guidance on the duration of the tariffs and access to affordable power. In the near term, key negotiations—such as potential exemptions for Canadian imports and further global aluminum market consolidation—are expected to play a critical role in shaping both finished goods and scrap aluminum prices.

Copper prices have also surged, climbing more than 5% in the U.S., far exceeding other benchmark prices, after President Trump suggested that copper imports could face a 25% tariff. The market reacted strongly to his congressional address on Tuesday March 4 as traders adjusted their expectations for larger and sooner-than-anticipated levies. However, despite an overnight increase of more than $0.20/lb. in copper prices, the scrap market has remained steady, with mills and smelters widening their spreads and keeping buying prices unchanged.

Stainless steel scrap prices remain stable, trading sideways at the beginning of March as the nickel market has shown little reaction to the impending tariffs on Canadian goods. Given that Canada is the U.S.’s most significant source of nickel and a key driver of stainless steel pricing, the lack of movement in the market is surprising. Uncertainty remains high in the nickel and stainless steel sectors, leaving many market participants waiting to see how the situation unfolds.

Spring cleaning season is here! Clear out your scrap while prices are hot! Let BL Duke handle the heavy lifting—reach out today!