Demand for scrap has maintained its momentum into the second quarter of 2021. It has remained strong for both ferrous and non-ferrous markets domestically and abroad. The forecast is bullish well into the summer months.

No. 1 Busheling – BL Duke

Most ferrous markets enjoyed an increase, however, the increases varied throughout each region. The Chicago ferrous scrap market has followed Detroit’s lead and again held prime scrap sideways. Cut grades, shred, and steel turnings increased by $20 per gross ton from April to May. Local mills bought limited quantities due to inventory management and upcoming maintenance outages. The lean buy created enough downward pressure to keep prime grades at April’s prices and cut grades gaining a slight price up-tick.

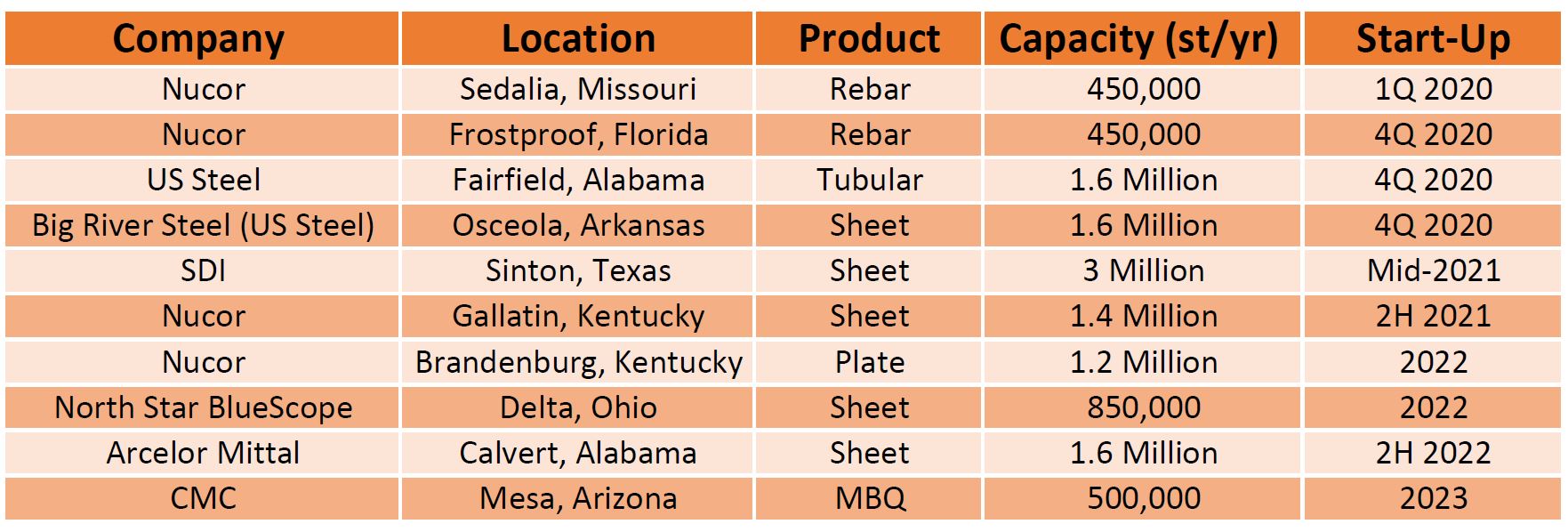

At a recent ISRI ferrous scrap metal spotlight, the focus was on “clean steel” or high quality steel with emissions of carbon dioxide and other greenhouse gases severely curtailed. The United States is a leader producing the cleanest steel with the fewest emissions worldwide and the recycling industry is a supporter of the initiative. Steel mills are shifting from Blast Furnaces (BOF) to newer cleaner technology of Electric Arc Furnaces (EAF). EAFs have a large appetitive for scrap metal and use 75% in their melt compared to BOFs that use 25% scrap metal. The United States alone has 8M tons of EAF capacity expected to ramp up in 2021 and 2022. Higher quality clean steel requires higher quality scrap metal. The added EAF capacity will only increase demand for high quality scrap grades like No. 1 Busheling.“Prime grades are currently undervalued,” says Lou Plucinski, President. “There’s a growing list of EAFs coming on line, the Futures Market is hot, mill capacity utilization is close to 80%, and the spread between HRC and Busheling is at $800 plus per ton. Not withstanding some unforeseen political or global upset, it’s safe to say the ferrous scrap market is bullish for the remainder of the year.”

New EAF Capacity – Argus Metals

As the first week of May comes to an end, non-ferrous markets are showing no signs of slowing down. Copper and aluminum scrap markets have continued to gain strength daily, with copper approaching an all time high, trading at $4.59 on May 6. It has been an interesting year for the copper industry. In April 2020, copper fell below $2.00 and now prices are within 10 cents of an all-time high.

Copper and Aluminum – BL Duke

The aluminum scrap market is maintaining the same slow and steady climb that we have seen since the onset of 2021. Prices for aluminum mill-grade scrap climbed to new highs in the United States due to robust demand, along with gains on the London Metal Exchange (LME). Smelters, Domestic mills, and International mills’ demand remains very strong, with delivery appointments easy to secure. Translated, the outlook for aluminum pricing is bullish for the foreseeable future.

Stainless steel scrap prices have not been following the recent uptick of the LME nickel price. Heading into the summer, it is widely expected stainless steel mills will slow their purchases and follow normal summer maintenance shutdowns. Stainless steel mills in India also have been out of the market for the past 3 to 4 weeks due to their Covid-19 outbreak. These mills are donating their oxygen to the hospitals causing several shutdowns.

Spring has sprung! Is your facility ready for some spring cleaning? Contact us to learn how our Demolition Team can help with machinery removal and plant clean-ups.