While the U.S. steel and scrap metal market has seemed poised to move forward in recent months it has lacked the momentum needed to make any true gains. “The domestic outlook for steel: Is the glass half-empty or half-full,” asked Jim Tumulty of Seaport Group LLC in the American Metal Market article, Steel market set for status quo: Tumulty. In 2012, the U.S. economy stabilized sufficiently enough to remove fear of another major economic collapse from the market. However, companies with excess capital have been unwilling to invest due to mixed signals and unanswered questions out of Washington, coupled with recessionary concerns that continue to exist overseas. “I know corporations are just sitting on massive amounts of cash and they don’t know what to do with it,” says Tumulty.

While the U.S. steel and scrap metal market has seemed poised to move forward in recent months it has lacked the momentum needed to make any true gains. “The domestic outlook for steel: Is the glass half-empty or half-full,” asked Jim Tumulty of Seaport Group LLC in the American Metal Market article, Steel market set for status quo: Tumulty. In 2012, the U.S. economy stabilized sufficiently enough to remove fear of another major economic collapse from the market. However, companies with excess capital have been unwilling to invest due to mixed signals and unanswered questions out of Washington, coupled with recessionary concerns that continue to exist overseas. “I know corporations are just sitting on massive amounts of cash and they don’t know what to do with it,” says Tumulty.

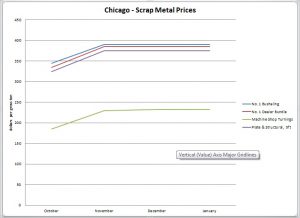

This brings us to where we are today, February 2013. The Chicago scrap metal market has heard rumors of price increases in each of the last three months, only to have prices move sideways once orders were placed. According to Scrap Trends Outlook (Vol. 4 No. 1, Jan. 22, 2013), February’s forecast appears to be much of the same. The publication states, “Although order books are not as strong as hoped for a few months ago, they are strong enough to keep mills busy.” Until mills start realizing an increase in demand there is no reason to believe that scrap prices will see any real strength. Historical data does not bode well for February either. “Prices have not risen across the board since in February since 2007. They fell in four of the past five years and had mixed results in 2010, when primes rose and other grades fell,” states the Scrap Trend Outlook.

Given such information there is no reason to believe that prices will rise when scrap contracts are finalized in February. I believe the market in the coming month will be sideways with a chance that prices may fall slightly.